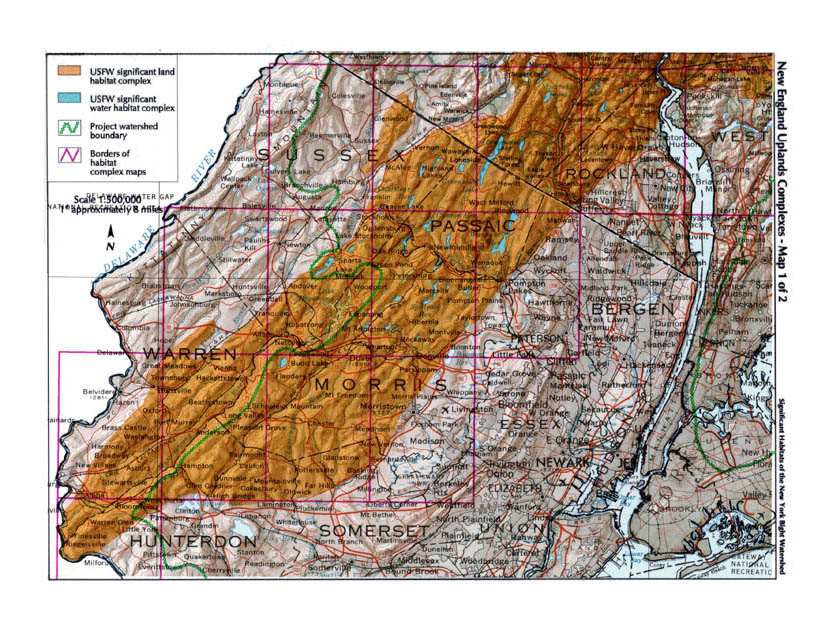

The Highlands Water Protection and Planning Act is a relative new law, signed by New Jersey’s then-Governor McGreevey on August 10, 2004. The Highlands Act seeks to protect the ecological integrity of the highlands region in northwest New Jersey. In short, the Act, under the New Jersey Department of Environmental Protection’s supervision, regulates and restricts development in the area. Indeed, it aims to protect and preserve not only the area’s animal and plant life but also a large source of fresh water for human consumption.

The New Jersey Highlands covers a vast span of the state covering over 1,250 square miles, and is home to nearly nine hundred thousand residents primarily in the counties of Warren, Morris, Hunterdon, Passaic, and Sussex.

Of the over eight hundred thousand acres of the Highlands region, nearly four hundred thousand acres have been designated as the Highlands Preservation Area. The remaining acres are designated as the Highlands Planning Area.

Continue reading

New Jersey Lawyers Blog

New Jersey Lawyers Blog